- Bringing a major change to India’s economy, the central government held the 56th GST Council meeting in New Delhi, chaired by Union Finance Minister Nirmala Sitharaman.

- In the meeting, a significant decision was taken to abolish the existing 12% and 28% tax slabs from the four current GST slabs. Now, only two tax slabs – 5% and 18% – will remain. These changes will be effective from 22nd September.

- The decision was taken unanimously, and no voting was required.

Why was the change necessary ?

Since the implementation of GST, complaints from the general public and businesses have been coming in that the tax structure is complex, and having multiple slabs creates confusion.

- Earlier, GST rates ranged from 0%, 5%, 12%, 18%, to 28%.

- Many goods and services became expensive due to being in higher tax slabs.

- The government believes that by reducing the number of rates and having only two main slabs, consumers will get relief, and compliance will become easier for businesses.

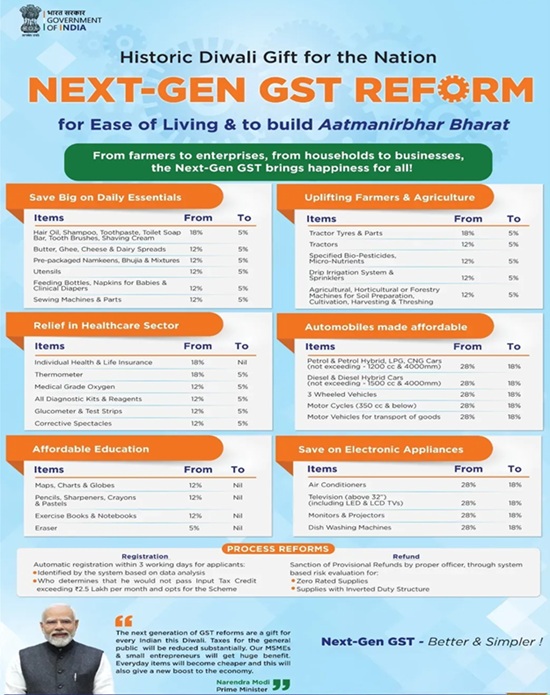

Major changes in GST: What has become cheaper and what has become expensive?

The GST Council recently took several major decisions, which will provide relief to both the public and businesses. However, taxes on some goods and services have increased. Let’s take a detailed look—

What has become cheaper under the new GST slabs ?

Food and beverages

- Milk and milk-based products:

- UHT (packaged) milk – completely tax-free

- Condensed milk, butter, ghee, paneer, and cheese – reduced from 12% to 5% or zero

- Staple foods:

- Malt, starch, pasta, cornflakes, biscuits, chocolate, and cocoa products – reduced from 12–18% to 5%

- Dry fruits:

- Almonds, pistachios, cashews, dates, hazelnuts – reduced from 12% to 5%

- Sugar and sweets:

- Toffees, candies, refined sugar, and sugar syrup – now 5%

- Packaged food:

- Vegetable oil, animal fat, sausages, meat/fish products, malt-extract-based packaged food – only 5%

- Snacks and namkeen:

- Namkeen, bhujia, mixture (except roasted chana) – reduced from 18% to 5%

- Water:

- Mineral water (without sugar/flavor), natural or artificial – reduced from 18% to 5%

Agriculture and fertilizers

- Fertilizers – reduced from 12–18% to 5%

- Seeds and crop nutrients – reduced from 12% to 5%

Health and education

- Life-saving medicines, health-related products, some medical devices – reduced from 12–18% to 5% or zero

- Educational services, books, and learning kits – reduced from 5–12% to zero or 5%

Special relief:

- Health and life insurance are now completely GST-free

- Earlier, they were taxed at 18%; now they are zero.

- This will make health services and insurance plans more affordable.

Consumer goods

- Electronics (for general use) – reduced from 28% to 18%

- Shoes and clothing – reduced from 12% to 5%

- Certain categories of paper – reduced from 12% to zero

- Hair oil, shampoo, dental floss, toothpaste – reduced from 18% to 5%

Other sectors

- Renewable energy devices – reduced from 12% to 5%

- Construction materials (major raw materials) – reduced from 12% to 5%

- Sports equipment and toys – reduced from 12% to 5%

- Leather, wood, and handicrafts – 5%

Automobiles and durables

- Small cars (≤1200cc petrol, ≤1500cc diesel), motorcycles below 350cc, and three-wheelers – reduced from 28% to 18%

- Buses, trucks, and ambulances – now 18%

- Auto parts – 18%

- Air conditioners, dishwashers, and TVs (all sizes) – reduced from 28% to 18%

What Has Become More Expensive Under the New GST Slabs?

Sin Goods

- Pan masala, gutkha, cigarettes, chewing tobacco, zarda, bidi – high GST + compensation cess will continue.

- Valuation will now be based on Retail Sale Price (RSP) instead of transaction value.

- Sugary/flavored beverages (including aerated water) – increased from 28% to 40%.

Luxury and Premium Items

- Cigarettes, premium alcohol, expensive cars – now 40% slab.

- Imported armored luxury cars will get tax exemptions only in special cases (e.g., President’s Secretariat).

Energy and Fuel

- Coal – increased from 5% to 18%.

Financial Impact on Government

- Reduction in rates will cause a revenue loss of ₹93,000 crore for the government.

- However, luxury tax and the 40% slab will generate approximately ₹45,000 crore additional revenue.

- No decision has yet been made on how states will be compensated for GST losses.

Expert Opinions

- Economists believe this decision will boost consumer spending and help control inflation.

- Education and agriculture sectors will benefit directly from GST relief, providing ease to rural populations and students.

- However, states are concerned that the center needs to establish a permanent mechanism to compensate for revenue losses.

Way Forward

- The new rates will be effective from 22nd September. This step is considered a major reform to simplify India’s tax system and protect consumer interests.

- The challenge will be how the government compensates the revenue loss while maintaining balance between central and state finances.

- Rate reductions are expected to cause a revenue loss of about ₹93,000 crore, while the 40% slab is projected to bring around ₹45,000 crore additional revenue.

What is GST (Goods and Services Tax) ?

- GST is a comprehensive indirect tax system implemented in India, which integrates most of the indirect taxes previously levied by the Central and State Governments. It was implemented on 1st July 2017.

- Tax System Before GST: Before GST, various indirect taxes were levied:

|

Level

|

Tax Name

|

|

Central Government

|

Excise Duty, Service Tax, Customs Duty, etc.

|

|

State Government

|

VAT (Value Added Tax), Entry Tax, Entertainment Tax, Luxury Tax, etc.

|

Types of GST

|

Type

|

Full Form

|

Applicability / Where Levied

|

|

CGST

|

Central GST

|

Levied on intra-state transactions, goes to the Central Government

|

|

SGST

|

State GST

|

Levied on intra-state transactions, goes to the State Government

|

|

IGST

|

Integrated GST

|

Levied on inter-state transactions, collected by the Central Government and shared with States

|

|

UTGST

|

Union Territory GST

|

Levied in Union Territories

|

GST Council:

|

Point

|

Details

|

|

Formation

|

Under the Constitution (101st Amendment) Act, 2016 (Article 279A) – deals with finance, property, contracts, and disputes

|

|

Chairperson

|

Union Finance Minister of India

|

|

Members

|

Finance Ministers of all States and Union Territories

|

|

Main Functions

|

Decide GST rates, make decisions on tax policies, advise on Compensation Cess, etc.

|

|

Question: Who chairs the GST Council ?

(a) Prime Minister

(b) President

(c) Union Finance Minister

(d) RBI Governor

Question: Under which Article was the GST Council constituted ?

(a) Article 265

(b) Article 280

(c) Article 279A

(d) Article 246A

Question: According to the new GST rates, what will be the tax on health and life insurance ?

(a) 18%

(b) 12%

(c) 5%

(d) Zero

|