| (Prelims: Current Affairs) |

Why in the News

The Central Government has supported 128 start-ups across the country with an investment of ₹257.77 crore under the Electronics Development Fund (EDF) until October 2025.

About EDF

- On February 15, 2016, the Government of India established the Electronics Development Fund (EDF) to strengthen design, manufacturing, and technological innovation-led growth.

- It functions under the Ministry of Communications and Information Technology.

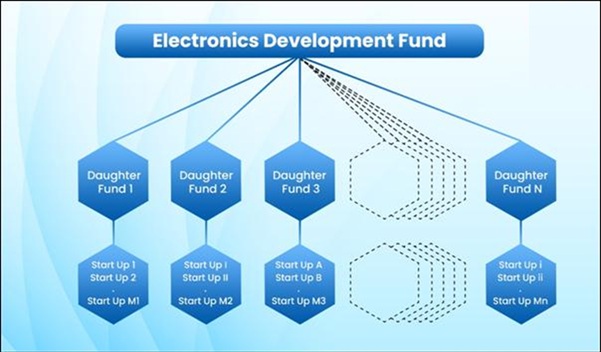

- It is based on a Fund of Funds model, meaning it does not invest directly in startups but instead invests capital in professionally managed 'daughter funds' (e.g., angel venture funds, early-stage investment funds).

- These daughter funds further invest in startups and technology companies.

- In this way, EDF helps create a self-reliant and innovation-oriented electronics ecosystem in India.

Key Goals

- Fostering innovation and research

- Supporting daughter funds

- Developing new products and technologies

- Strengthening domestic design capabilities

- Creating a national intellectual property (IP) pool

- Strategic technology acquisitions

Fund Operations

EDF operates through a transparent, flexible, and professional structure.

Key Features

- EDF's investments are made on a non-exclusive basis, allowing for greater collaboration.

- EDF's share in each daughter fund is determined based on market needs and the fund manager's capabilities.

- EDF generally holds a minority stake to ensure greater participation from private investors.

- The fund manager is given considerable autonomy in raising funds, investing, and monitoring the progress of startups.

- All daughter funds must be registered in India under the SEBI AIF Regulations 2012 (Category I or II).

- The investment scope covers the entire value chain of electronics, IT, robotics, AI, cybersecurity, and related sectors.

Achievements and Impact (as of September 30, 2025)

- EDF invested ₹257.77 crore in 8 daughter funds.

- These daughter funds further invested ₹1,335.77 crore in 128 startups.

- Supported startups include companies in emerging sectors such as IoT, robotics, drones, healthtech, cybersecurity, AI/ML.

- More than 23,600 high-tech jobs created so far.

- A total of 368 intellectual properties (IPs) created or acquired.

- Successful exits from 37 investments in 128 startups.

- EDF received a return of ₹173.88 crore from exits and partial exits.

Conclusion

The Electronics Development Fund has played a key role in fostering innovation and entrepreneurship in India's electronics and IT sectors. By enabling access to risk capital, it has supported startups working on advanced technologies and contributed to the expansion of domestic design and intellectual property creation.