Prelims: (Crude Oil Imports + CA)

Mains: (GS 2 – International Relations; GS 3 – Security, Economy) |

Why in News ?

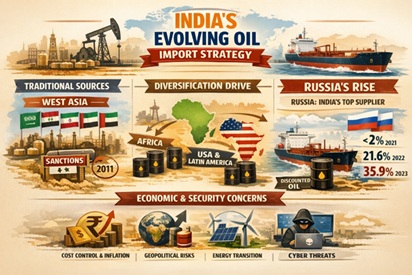

India’s crude oil sourcing pattern has undergone a significant transformation over the past decade. Once heavily dependent on West Asian suppliers, India has increasingly diversified its oil import basket—most notably with Russia emerging as the largest supplier since 2022. This shift reflects India’s pragmatic energy diplomacy, balancing geopolitical risks, sanctions regimes, and economic imperatives such as cost control and inflation management.

Background & Context

Energy security has remained a central pillar of India’s economic and strategic planning. As the world’s third-largest oil consumer and importer, India depends on imports for over 85% of its crude oil needs. Historically, this dependence exposed India to geopolitical instability in West Asia, price volatility, and supply disruptions.

Over time, India recalibrated its oil strategy from supplier concentration to diversified sourcing, prioritising flexibility, affordability, and resilience over rigid geopolitical alignments. This transition has accelerated amid global disruptions—sanctions on Iran, the Russia–Ukraine war, and shifting energy geopolitics.

West Asia: The Traditional Backbone of India’s Oil Imports

- Prior to 2005, over 70% of India’s crude imports originated from West Asia.

- Key suppliers included Saudi Arabia, Iraq, Iran, Kuwait, UAE, Oman, and Qatar.

- Even in 2011–12, more than 60% of imports came from seven West Asian countries:

- Saudi Arabia (~17%)

- Iran (11.3%)

- Iraq (10.5%)

- UAE (9%)

- Kuwait (7%)

- Oman (3.4%)

- Qatar (3.3%)

African suppliers (Nigeria and Angola) formed a secondary source, contributing roughly one-fifth of total imports.

Iran Sanctions and the Reshaping of India’s Crude Basket

Sanctions Shock

- UNSC sanctions (2010) and US unilateral sanctions (2011) on Iran severely constrained India–Iran oil trade.

- Restrictions on Iran’s Central Bank and threats to penalise foreign banks increased transaction risks.

Impact on Imports

- Iran’s share declined steadily:

- 7.1% (2012–13)

- 5.8% (2013–14)

- 5.7% (2014–15)

- 6.2% (2015–16)

This phase underscored how geopolitics can override economic logic, compelling India to rework its energy sourcing strategy.

Iran Sanctions, Temporary Revival & India’s Diversification Push

- Following the 2016 nuclear agreement, sanctions relief allowed a brief revival.

- Iran’s share rebounded to 12.7% in 2016–17.

Reversal after 2017

- Reimposition of US sanctions under the Trump administration led to:

- Sharp decline post-2017

- 91.8% cut in Iranian imports by 2019–20

Structural Diversification

India increasingly turned to:

- UAE and Saudi Arabia (Middle East stability)

- United States (shale oil)

- Africa and Latin America

Current import profile:

- Middle East: 40–45%

- Africa: 8–10%

- Americas: 10–12%

Russia Emerges as India’s Largest Crude Supplier

Trigger: Russia–Ukraine Conflict (2022)

- Western sanctions forced Russia to divert crude at discounted prices.

- India adopted a cost-centric, non-aligned approach.

Surge in Russian Oil Share

- <2% in 2021–22

- 21.6% in 2022–23

- 35.9% in 2023–24

- 35.8% in 2024–25

Today, around one-third of India’s crude imports come from Russia.

Economic Logic

- Russian Urals crude price:

- $79.41/barrel (April 2022)

- $66.49/barrel (March 2025)

- Indian refineries were technically compatible, ensuring smooth transition.

Why Russian Oil Is Hard to Replace ?

- Higher freight costs from alternative suppliers

- Loss of discounts

- Pressure on refinery margins

- Potential rise in fuel prices and inflation

- Risk of fiscal and political backlash

Challenges and Way Ahead

Geopolitical Vulnerability

- Overdependence on any single supplier poses long-term risks.

- Way Forward: Maintain a diversified, multi-regional import strategy.

Energy Transition Pressures

- Fossil fuel dependence conflicts with climate commitments.

- Way Forward: Accelerate renewable energy, green hydrogen, and biofuels.

Price Volatility & Fiscal Stress

- Oil price shocks affect inflation and current account deficit.

- Way Forward: Strengthen strategic petroleum reserves and hedging mechanisms.

FAQs

Q1. Why has India diversified its oil import basket ?

To reduce geopolitical risks, manage price volatility, and enhance energy security.

Q2. Why did Russian oil become attractive to India ?

Due to deep discounts, refinery compatibility, and economic prudence amid global sanctions.

Q3. Has West Asia lost relevance for India ?

No. It remains a key supplier, though its dominance has reduced.

Q5. What is India’s long-term solution to oil dependence ?

Diversification, strategic reserves, and a gradual shift to renewable energy.

|