(Mains GS 3 : Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.)

Context:

- The Government has made several efforts to formalise the economy as the formal sector is more productive than the informal sector, and formal workers have access to social security benefits.

Simplifying the process:

- Efforts based on the “fiscal perspective” of formalisation like currency demonetisation, introduction of the Goods and Services Tax (GST), digitalisation of financial transactions and enrolment of informal sector workers on numerous government Internet portals are all meant to encourage the formalisation of the economy.

- This perspective appears to draw from a strand of thought advanced by some international financial institutions such as the International Monetary Fund, which foregrounds the persistence of the informal sector to excessive state regulation of enterprises and labour which drives genuine economic activity outside the regulatory ambit.

- It underplays informality as an outcome of structural and historical factors of economic backwardness and excessive regulation and taxation ensure the endurance of informal activities.

- Hence, it is believed that simplifying registration processes, easing rules for business conduct, and lowering the standards of protection of formal sector workers will bring informal enterprises and their workers into the fold of formality.

Long lineage:

- The fiscal perspective has a long lineage in India going back to tax reforms initiated in the mid-1980s.

- Early on, in an attempt to promote employment, India protected small enterprises engaged in labour intensive manufacturing by providing them with fiscal concessions and regulating large-scale industry by licensing.

- However such measures led to many labour-intensive industries getting diffused into the informal/unorganised sectors.

- Further, they led to the formation of dense output and labour market inter-linkages between the informal and formal sectors via sub-contracting and outsourcing arrangements (quite like in labour abundant Asian economies).

Textile industry case:

- In the textile industry, the rise of the power looms at the expense of composite mills in the organised sector and handlooms in the unorganised sector best illustrates the policy outcome.

- While such policy initiatives may have encouraged employment, bringing the enterprises which benefited from the policy into the tax net has been a challenge.

- The challenge is not only administrative but political and economic reasons operating at the regional/local level in a competitive electoral democracy are responsible for this phenomenon, too.

Lack of adequate growth:

- Widening the tax net and reducing tax evasion are necessary but the global evidence suggests that the view that legal and regulatory hurdles alone are mainly responsible for holding back formalisation does not hold much water.

- A well-regarded study, ‘Informality and Development’, argues that the persistence of informality is, in fact, a sign of underdevelopment.

- Across countries, the paper finds a negative association between informality (as measured by the share of self-employed in total workers) and per capita income as finding suggests that informality decreases with economic growth, albeit slowly.

- A similar association is also evident across major States in India, based on official PLFS data.

- Hence, the persistence of a high share of informal employment in total employment seems nothing but a lack of adequate growth or continuation of underdevelopment.

Transformation in Asia:

- The defining characteristic of economic development is a movement of low-productivity informal (traditional) sector workers to the formal or modern (or organised) sector known as structural transformation.

- East Asia witnessed rapid structural change in the second half of the 20th century as poor agrarian economies rapidly industrialised, drawing labour from traditional agriculture.

- However, in many parts of the developing world, including India, informality has reduced at a very sluggish pace, manifesting itself most visibly in urban squalor, poverty and (open and disguised) unemployment.

Informality in India:

- Despite witnessing rapid economic growth over the last two decades, 90% of workers in India have remained informally employed, producing about half of GDP.

- Combining the International Labour Organization’s widely agreed upon template of definitions with India’s official definition (of formal jobs as those providing at least one social security benefit such as EPF), the share of formal workers in India stood at 9.7% (47.5 million).

- Official PLFS data shows that 75% of informal workers are self-employed and casual wage workers with average earnings lower than regular salaried workers.

- Significantly, the prevalence of informal employment is also widespread in the non-agriculture sector and about half of informal workers are engaged in non-agriculture sectors which spread across urban and rural areas.

Challenge of informality:

- Despite (well-intentioned) efforts at formalisation, the challenge of informality looms large for India and the novel coronavirus pandemic has only exacerbated this challenge.

- Research by the State Bank of India recently reported the economy formalised rapidly during the pandemic year of 2020-21, with the informal sector’s GDP share shrinking to less than 20%, from about 50% a few years ago.

- As we have argued elsewhere, these findings of a sharp contraction of the informal sector during the pandemic year (2020-21) do not represent a sustained structural transformation of the low productive informal sector into a more productive formal sector.

- However,the contraction of the informal sector is a temporary outcome of the pandemic and severe lockdowns imposed in 2020 and 2021.

Policy efforts:

- Policy efforts directed at bringing in the tip of the informal sector’s iceberg into the fold of formality by alleviating legal and regulatory hurdles are laudable.

- However, these initiatives fail to appreciate that the bulk of the informal units and their workers are essentially petty producers (self-employed and casual workers) eking their subsistence out of minimal resources.

- Therefore, these attempts will yield limited results and continued dominance of informality defines under-development.

Conclusion:

- A mere registration under numerous official portals will not ensure access to social security, considering the poor record of implementation of labour laws.The economy will get formalised when informal enterprises become more productive through greater capital investment and increased education and skills are imparted to its workers.

Contact Us

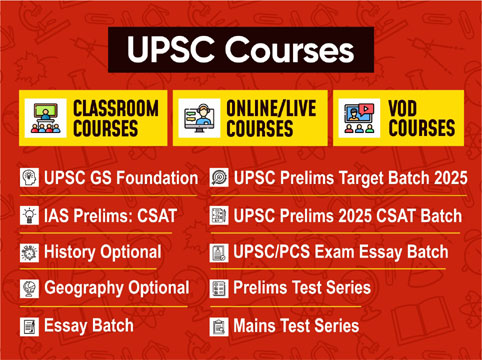

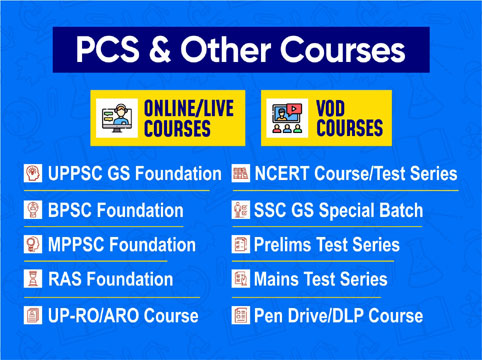

Contact Us  New Batch : 9555124124/ 7428085757

New Batch : 9555124124/ 7428085757  Tech Support : 9555124124/ 7428085757

Tech Support : 9555124124/ 7428085757