India’s energy transition has reached a critical juncture. Despite rapid expansion of renewable energy, challenges such as baseload power deficits, grid instability, and deep decarbonisation requirements have brought nuclear energy back to the centre of policy discourse.

In this context, the Nuclear Energy Bill, 2025, approved by the Union Cabinet, is being viewed as a historic reform in one of India’s most closed sectors—the civil nuclear energy domain.

Background and Key Provisions of the Bill

Amendment to the Atomic Energy Act, 1962

Status quo till now:

- Complete ownership and operation of nuclear power plants rested exclusively with the government through the Nuclear Power Corporation of India Limited (NPCIL).

- Participation of private and foreign entities was prohibited.

Proposed reforms:

- Allowing private companies up to 49% equity participation in nuclear power projects.

- Expanding private sector involvement in:

- Nuclear mining

- Fuel fabrication

- Equipment manufacturing

- Plant operations

- Opening pathways for foreign investment via Sovereign Wealth Funds (SWFs).

Reform of the Civil Liability for Nuclear Damage Act (CLNDA), 2010

Problematic clause – Operator’s Right of Recourse:

- In case of a nuclear accident, the operator (NPCIL) can seek compensation from suppliers.

- This provision was seen as a major investment deterrent by foreign firms such as Westinghouse and EDF.

Proposed solutions:

- Fixing an upper cap on liability

- Creation of a government-backed insurance pool/fund

- Aligning India’s liability framework with global nuclear liability norms

These reforms would unlock the commercial potential of the India–US Civil Nuclear Agreement (2008).

India’s Baseload Power Challenge and the Nuclear Option

Limitations of Renewable Energy

- Solar and wind energy are intermittent

- Energy storage technologies remain costly and insufficient

- Peak evening demand + low solar output often leads to grid stress

Why Nuclear Energy Matters

- Provides 24×7 reliable baseload power

- Much lower carbon emissions than coal

- Enhances energy security while supporting climate commitments

Nuclear Capacity Expansion Roadmap

|

Year

|

Nuclear Capacity

|

|

Present

|

< 8 GW

|

|

Target (2047)

|

100 GW

|

Global Comparison

- United States: ~100 GW

- France: ~65 GW

- China: ~58 GW

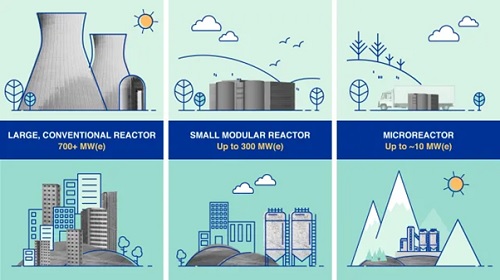

Small Modular Reactors (SMRs): India’s New Strategic Pivot

What are SMRs ?

Small Modular Reactors (SMRs) are advanced nuclear reactors that:

- Typically generate 50–300 MW

- Are factory-built in modular form and assembled on-site

- Are safer, smaller, more flexible, and cost-effective compared to large reactors

India’s Initiatives

- ₹20,000 crore Nuclear Energy Mission for SMR R&D

- Target to commission 5 indigenous SMRs by 2033

- Three key designs developed by BARC:

- BSMR – 200 MW (LWR)

- SMR – 55 MW (LWR)

- BSR – 220 MW (PHWR)

These developments position India as a future exporter of nuclear technology.

Role of the Private Sector: Opportunities and Challenges

Interested Private Players

- Reliance, Tata Power, Adani Power

- JSW Energy, Hindalco, Jindal Steel

- 16 potential sites identified across 6 states

Proposed Model

- Ownership & operation: NPCIL

- Capital investment: Private companies

- Benefit: Captive power supply for industry

Key Challenges

- Ambiguity over ownership and tariff structures

- Long-term financial viability

- Regulatory oversight and nuclear safety concerns

Geopolitical and Strategic Dimensions

- India–US Relations

- Revival of civil nuclear cooperation

- Trust-building for broader trade and investment agreements

- Energy Diplomacy

- Interest from Middle Eastern sovereign wealth funds

- Continued cooperation with:

- Russia (Kudankulam project)

- France (technology and fuel cycle support)

- Climate Leadership

- Supports India’s Net Zero by 2070 commitment

- Gradual reduction in coal dependency

Net Zero 2070:

- Announced by India at COP-26

- Objective: Achieve net-zero greenhouse gas emissions by 2070

- Implemented through a five-point climate action plan, including:

- Reducing emission intensity by 2030

- Achieving 50% energy from renewables by 2030

- Expanding non-fossil fuel capacity to 500 GW by 2030

Nuclear Power Plants of India

All commercial nuclear power plants in India are operated by NPCIL – Nuclear Power Corporation of India Limited (under the Department of Atomic Energy).

India’s Nuclear Power Status (Quick Facts – Prelims Ready)

- Total Nuclear Power Stations: 8

- Total Operational Reactors: 22

- Total Installed Capacity: ~7.5–8 GW

- Major Reactor Technologies:-

- PHWR (Pressurised Heavy Water Reactor) – Indigenous technology.

- LWR (Light Water Reactor – VVER) – Russian collaboration.

List of Nuclear Power Plants in India

|

S. No.

|

Nuclear Power Plant

|

State

|

Reactor Type

|

Units

|

Capacity (MW)

|

Key Facts

|

|

1

|

Tarapur Atomic Power Station (TAPS)

|

Maharashtra

|

BWR + PHWR

|

4

|

1400

|

India’s first nuclear power plant (1969)

|

|

2

|

Rajasthan Atomic Power Station (RAPS)

|

Rajasthan (Rawatbhata)

|

PHWR

|

6

|

1180

|

Highest number of PHWR units

|

|

3

|

Madras Atomic Power Station (MAPS)

|

Tamil Nadu (Kalpakkam)

|

PHWR

|

2

|

440

|

First nuclear plant in South India

|

|

4

|

Narora Atomic Power Station (NAPS)

|

Uttar Pradesh

|

PHWR

|

2

|

440

|

Located on the bank of the Ganga River

|

|

5

|

Kakrapar Atomic Power Station (KAPS)

|

Gujarat

|

PHWR

|

4

|

1140

|

Features 700 MW indigenous PHWR reactors

|

|

6

|

Kaiga Generating Station (KGS)

|

Karnataka

|

PHWR

|

4

|

880

|

Located in a dense forest region

|

|

7

|

Kudankulam Nuclear Power Plant (KKNPP)

|

Tamil Nadu

|

LWR (VVER – Russia)

|

2 (operational)

|

2000

|

Largest nuclear power plant in India

|

|

|

|

|

Units 3, 4, 5 & 6

|

—

|

Under construction / proposed

|

|

8

|

Gorakhpur Haryana Anu Vidyut Pariyojana (GHAVP)

|

Haryana

|

PHWR

|

2

|

1400

|

Under construction, emerging nuclear hub of North India

|