Prelims: (Cybersecurity + CA)

Mains: (GS 2 – Governance; GS 3 – Cybersecurity, Law & Order; GS 4 – Ethics) |

Why in News ?

India has recorded a sharp escalation in cyber-enabled financial crimes during 2024–25, particularly a new form of intimidation-based fraud popularly termed as the “digital arrest” scam. Multiple incidents involving losses of several crores, prolonged psychological confinement of victims via video calls, and impersonation of senior law-enforcement or judicial officials have raised serious concerns. Courts and central agencies have taken cognisance of the growing threat, highlighting cyber fraud as not merely an economic crime but a challenge to internal security and public trust.

Background & Context

India’s digital transformation—driven by UPI payments, Aadhaar-based services, online banking, remote working, and smartphone penetration—has dramatically expanded access to services and financial inclusion. However, this rapid digitisation has also created new vulnerabilities.

Cybercrime in India has evolved in three phases:

- Basic frauds – lottery scams, fake calls, simple cheating

- Financial-tech frauds – OTP theft, phishing, UPI frauds

- Psychological & authority-based cybercrime – digital arrest, impersonation, coercive extortion

The “digital arrest” scam represents a qualitative shift, where fear of the state and legal institutions is deliberately exploited using digital tools, fake documents, and prolonged psychological pressure.

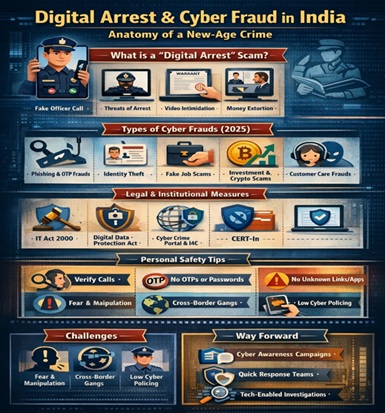

What is a “Digital Arrest” Scam ?

Conceptual Explanation

A digital arrest scam refers to a cyber fraud technique where criminals impersonate:

- Police officials

- Investigative agencies (CBI, ED, NCB)

- Courts or regulatory authorities

They falsely accuse victims of grave offences such as money laundering, terror financing, drug trafficking, or cybercrime, and claim that immediate arrest is warranted unless the victim complies with instructions.

Crucial Fact: There is no legal provision in India for arrest, detention, interrogation, or trial via phone call or video conferencing initiated by enforcement agencies.

Typical Modus Operandi

- Initial Contact

- Phone call or WhatsApp call from spoofed numbers

- Caller claims association with police, court registry, or investigative agency

- Authority Projection

- Use of uniforms, official language, forged ID cards

- Fake FIRs, warrants, court orders shared digitally

- Fear Creation

- Allegations of serious crimes

- Threats of arrest, account freeze, passport cancellation, or media exposure

- Psychological Isolation

- Victim ordered to remain on continuous video call

- Instructions not to inform family, lawyers, or friends

- Financial Extortion

- Demand for “verification amount”, “security deposit”, or “fine”

- Money transferred through UPI, bank transfer, mule accounts

Types of Cyber Frauds in India

1. Digital Arrest / Authority Impersonation Scams

- Exploit fear of law-enforcement and judiciary

- High-value frauds with deep psychological impact

2. Phishing and OTP-Based Frauds

- Fake SMS, emails, or websites mimicking banks and apps

- OTP and credential theft leading to instant fund drain

3. Identity Theft & Profile Impersonation

- Fake social media or messaging profiles

- Used for fraud, blackmail, or reputational damage

4. Fake Job & Recruitment Scams

- Promises of government/private jobs

- Victims pay “registration”, “medical”, or “training” fees

5. Investment & Crypto Scams

- Fake trading platforms and Ponzi schemes

- Promise guaranteed or unusually high returns

6. Customer-Care & Technical Support Scams

- Fake helpline numbers

- Remote access apps used to control devices

7. Ransomware & Malware Attacks

- Data encryption or device locking

- Demand for ransom to restore access

Recent Trends and Key Concerns

- Victims include senior citizens, professionals, students, government employees

- Financial losses often exceed ₹10–50 lakh per case

- Funds are routed via:

- Mule accounts

- Shell accounts

- Layered digital wallets

- Many networks operate cross-border

- Significant under-reporting due to fear, shame, or lack of awareness

Legal Framework Governing Cyber Fraud in India

Key Laws Applicable

- Information Technology Act, 2000

- Identity theft

- Cheating by personation

- Cyber fraud offences

- Bharatiya Nyaya Sanhita / IPC

- Cheating

- Forgery

- Criminal intimidation

- Criminal conspiracy

- Digital Personal Data Protection Act, 2023

- Misuse and unlawful processing of personal data

- Banking & Payment Regulations

- KYC norms

- Transaction monitoring

- Reporting of suspicious activities

Institutional & Administrative Measures

- Indian Cyber Crime Coordination Centre (I4C) – national coordination and response

- National Cyber Crime Reporting Portal – online complaint registration

- CERT-In – advisories and incident response

- Judicial Oversight – courts monitoring organised cyber fraud trends

- Telecom Measures – SIM verification, number blocking, spoofing detection

Personal Preventive Measures

Awareness-Based Measures

- Understand that no arrest happens digitally

- Treat urgent threats as red flags

Financial Safety Measures

- Never share OTPs, PINs, passwords

- Avoid scanning unknown QR codes

- Enable transaction alerts

Digital Hygiene

- Use strong passwords and two-factor authentication

- Update apps and operating systems regularly

- Avoid installing unknown apps or remote-access tools

Behavioural Measures

- Pause and verify before acting under pressure

- Discuss suspicious calls with trusted persons

- Report immediately to banks and cyber authorities

Challenges in Tackling Digital Arrest Scams

Psychological Complexity

- Fear-based manipulation reduces rational thinking

Technological Sophistication

- Spoofed calls, fake documents, deepfake visuals

Jurisdictional Constraints

- Cross-border operations hinder prosecution

Capacity Gaps

- Limited cyber expertise at local policing levels

Way Forward

- Nationwide cyber literacy and legal awareness campaigns

- Faster coordination between banks, telecom operators, and police

- Real-time account and SIM freezing mechanisms

- Capacity building of police and judiciary in cyber forensics

- Integration of cyber awareness into school and college curricula

FAQs

Q1. Is digital arrest legally valid in India ?

No. Indian law does not recognise arrest or investigation through phone or video calls.

Q2. Why are digital arrest scams particularly dangerous ?

They exploit fear, authority, and lack of legal awareness, leading to high-value fraud and psychological harm.

Q3. What should a person do if targeted ?

Disconnect immediately, verify independently, inform family and bank, and report to cyber authorities.

Q4. How does cyber fraud affect internal security ?

It erodes public trust, funds organised crime, and exploits digital infrastructure.

Q5. What is the long-term solution ?

Cyber literacy, strong institutions, coordinated enforcement, and responsible digital behaviour.

|