Prelims: (Economy + CA)

Mains: (GS 3 – Economic Development, Regional Disparities, Industrial Policy, Employment) |

Why in News ?

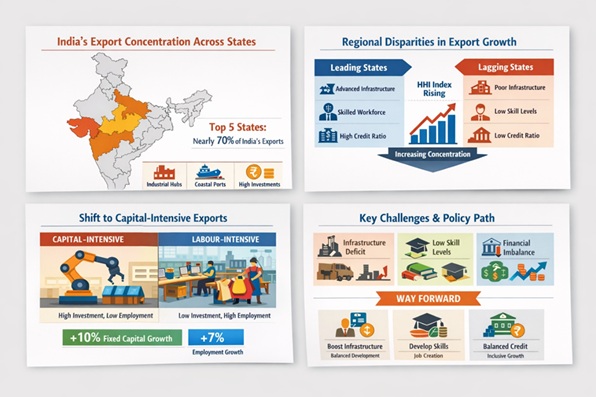

A recent analysis of RBI’s State-wise export data reveals that India’s export growth is increasingly concentrated in a few States, exposing deepening regional imbalances and questioning the assumption that export expansion automatically leads to broad-based industrialisation and employment generation.

Background & Context

At the national level, India’s export performance appears resilient, even amid a weakening rupee and global trade slowdown. However, a disaggregated, State-level analysis presents a contrasting picture. Export-led growth has become geographically skewed, benefiting already industrialised and coastal States, while large parts of the hinterland remain marginal participants. This pattern challenges traditional development models that viewed exports as a catalyst for industrialisation, job creation, and regional convergence.

Overview of India’s Export Performance

- Aggregate export figures suggest robustness and diversification.

- State-wise data from the RBI Handbook of Statistics on Indian States (2024–25) shows:

- Export growth is unevenly distributed.

- A small group of States accounts for a disproportionate share of total exports.

- This raises concerns about the quality and inclusiveness of export-led growth.

Concentration of Exports Among a Few States

- Five States dominate India’s export landscape:

- Maharashtra

- Gujarat

- Tamil Nadu

- Karnataka

- Uttar Pradesh

- Together, they contribute nearly 70% of India’s total exports.

- Half a decade ago, their share stood at around 65%, indicating rising concentration.

Measuring Concentration

- The Herfindahl–Hirschman Index (HHI) of exports has increased.

- HHI is used by anti-trust authorities to assess market concentration:

- Calculated by squaring the market share of each participant and summing the values.

- Rising HHI signals divergence, not convergence, in regional export performance.

Structural Reasons Behind Regional Divergence

Changing Nature of Global Trade

- The era of labour-intensive, low-skill manufacturing as a development ladder is narrowing.

- Global merchandise trade growth has slowed.

- Capital increasingly flows to regions with high economic complexity, not merely cheap labour.

Agglomeration Advantages in Export-Leading States

- Export-dominant States possess:

- Dense industrial clusters

- Advanced logistics and ports

- Skilled labour pools

- Strong supplier networks

- Financial depth

- These factors reinforce spatial clustering, making relocation to lagging regions costly.

Structural Deficits in Hinterland States

- Persistent shortages of:

- Infrastructure

- Human capital

- Institutional capacity

- These constraints limit entry into complex global value chains, trapping hinterland States in low-export equilibria.

Shift from Labour-Intensive to Capital-Intensive Exports

- Export growth is becoming capital-intensive rather than job-rich.

- Annual Survey of Industries (2022–23) data shows:

- Fixed capital investment grew by over 10%

- Employment growth lagged at about 7%

- Rising fixed capital per worker indicates capital deepening.

- Exports increasingly generate value without proportionate employment creation, weakening the traditional agriculture-to-manufacturing labour absorption pathway.

Employment Outcomes and Labour Market Trends

- Periodic Labour Force Survey (PLFS) findings:

- Manufacturing employment share stagnates at 11.6–12%, despite record exports.

- This suggests a decline in employment elasticity of exports.

- Export-linked jobs are concentrated in:

- Electronics hubs in Tamil Nadu

- Industrial clusters in Noida and western India

- Wage share in Net Value Added has declined, indicating productivity gains accrue more to capital than labour.

Financial and Institutional Constraints in Hinterland States

- Export-leading States often have Credit–Deposit (CD) ratios above 90%, allowing:

- Local recycling of savings into industry

- Lagging States such as Bihar and eastern Uttar Pradesh:

- CD ratios below 50%

- Capital flows out to already developed regions

- This creates a vicious cycle of underdevelopment:

- Capital flight

- Weak industrial capacity

- Continued exclusion from export growth

Rethinking Exports as a Development Metric

The emerging evidence suggests a structural shift:

- Exports are increasingly an outcome of prior development, not its cause

- States do not export their way into prosperity; they export because they already possess:

- Industrial depth

- Institutional strength

- Human capital

Relying solely on export growth as a proxy for development risks overlooking:

- Employment generation

- Regional equity

- Wage growth

- Human capital outcomes

Policy Implications and Way Forward

- Complement export promotion with:

- Infrastructure investment in lagging regions

- Skill development aligned with complex manufacturing

- Financial deepening in hinterland States

- Focus on:

- Employment-intensive sectors

- Regional industrial policy

- Balanced credit allocation

- Shift evaluation metrics from export volumes to inclusive development outcomes.

FAQs

Q1. What does the concentration of exports across States indicate ?

It reflects growing regional inequality and uneven industrial development.

Q2. Which States dominate India’s export basket ?

Maharashtra, Gujarat, Tamil Nadu, Karnataka, and Uttar Pradesh.

Q3. What is the Herfindahl–Hirschman Index (HHI) ?

A measure of concentration calculated by summing the squared market shares of participants.

Q4. Why is export growth no longer generating sufficient jobs ?

Because exports are increasingly capital-intensive, with rising capital per worker.

Q5. What is the key policy takeaway from this trend ?

Exports should be treated as an outcome of development, not a standalone development strategy.

|