Prelims: (Economy + CA)

Mains: (GS-3 – Economy) |

Why in the News?

The Government of India is set to introduce the Insurance Laws (Amendment) Bill, 2025 during the sixth session of the 18th Lok Sabha. The proposed legislation is expected to modernise India’s underpenetrated insurance sector, enabling higher foreign investment, eased market entry, and structural reforms. Industry experts believe the Bill could significantly expand India’s insurance ecosystem, attract global insurers, and spur long-term sectoral innovation.

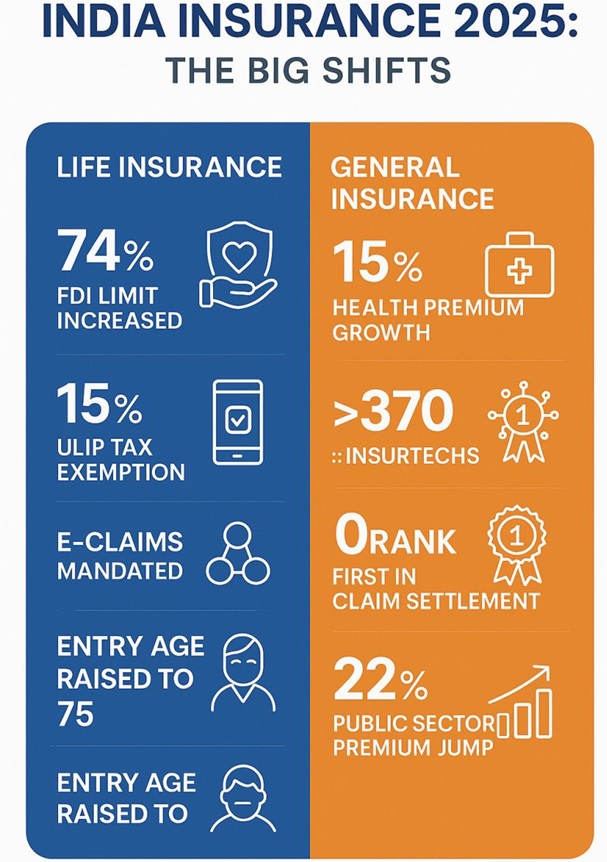

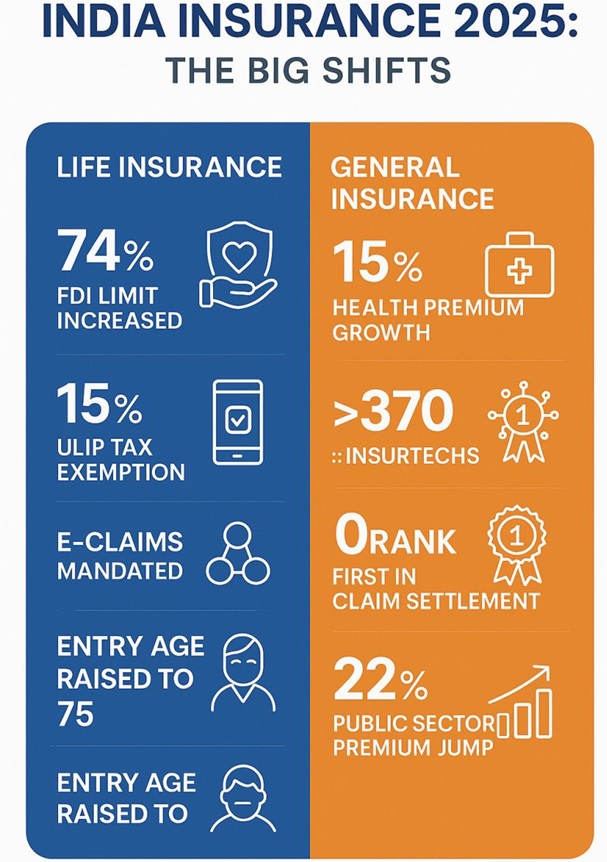

Background: FDI in Insurance Raised to 100%

- On 1st February 2025, the Finance Minister announced a landmark reform: raising FDI in insurance from 74% to 100%.

- This will enable deeper foreign participation, stronger capital inflows, and improved professional standards.

Acts Proposed for Amendment

- Insurance Act, 1938

- Life Insurance Corporation Act, 1956

- IRDAI Act, 1999

Opening the Indian Market for Global Leaders

- Of the world’s top 25 insurers, nearly 20 do not operate in India.

- The new framework may encourage their entry, while existing joint ventures could restructure into fully foreign-owned subsidiaries.

- Industry projections suggest India could develop a 1,000-insurer ecosystem over the next decade.

Why 100% FDI Could Transform India’s Insurance Sector

- India’s insurance penetration stands at just 3.7% (2023–24), significantly below the global average of 7%.

- Higher FDI strengthens:

- Capital availability

- Risk assessment capabilities

- Digital claims processing

- Underwriting sophistication

- Customer experience

The reform also supports deeper expansion into rural and underserved regions, where affordability and reach remain barriers.

Easier Entry Norms to Attract More Reinsurers

- Net owned funds requirement for foreign reinsurers may be reduced from ₹5,000 crore to ₹500 crore.

- This move is expected to diversify India’s reinsurance market, which is currently dominated by GIC Re.

- Greater competition may lead to better pricing and risk diversification.

Composite Licensing: A Unified Insurance Framework

- The Bill proposes composite licences, enabling insurers to sell life and non-life products under one umbrella.

- This replaces the rigid compartmentalisation of the Insurance Act, 1938.

- Composite licensing enables:

- Bundled products

- Seamless service delivery

- Integrated life, health, and general coverage

- Better alignment with evolving consumer needs

Lower Capital Requirements to Encourage New and Niche Insurers

- Current capital norms:

- ₹100 crore – insurers

- ₹200 crore – reinsurers

- The Bill proposes reducing these thresholds, especially to support:

- Regional insurers

- Micro-insurers

- Rural-focused companies

- Digital-first & niche players

This aligns with India’s goal of achieving “Insurance for All” by 2047.

Captive Insurers & Flexible Capital Norms

- Large corporations may be allowed to establish captive insurance companies to manage their own risks.

- Captive insurers improve:

- Claims management

- Risk coverage

- Financial control

- Differentiated capital norms will replace uniform requirements, encouraging innovation and diversified players.

Simplified Registration & Greater Flexibility for Intermediaries

- Intermediaries may receive perpetual, one-time registration, eliminating the current three-year renewal cycle.

- They must continue paying annual IRDAI fees.

- Individual agents may be permitted to sell products from multiple insurers, enhancing distribution reach and customer choice.

FAQs

1. What is the objective of the Insurance Laws (Amendment) Bill, 2025?

To modernize the regulatory framework, expand competition, deepen insurance penetration, and attract global players.

2. How will 100% FDI impact consumers?

It is likely to improve product variety, reduce premiums through competition, and ensure faster, tech-enabled services.

3. What is composite licensing?

A single licence allowing an insurer to offer life, general, and health insurance products, promoting integrated coverage solutions.

4. Why is lowering capital requirements significant?

It enables new insurers, regional entities, and specialized players to enter the market, especially in underserved geographies.

5. How will reforms affect intermediaries?

Simplified registration and multi-insurer selling permissions will expand last-mile outreach and enhance customer access.

|

Contact Us

Contact Us  New Batch : 9555124124/ 7428085757

New Batch : 9555124124/ 7428085757  Tech Support : 9555124124/ 7428085757

Tech Support : 9555124124/ 7428085757