Prelims: (Economy + CA)

Mains: (GS 3 – Economy) |

Why in News?

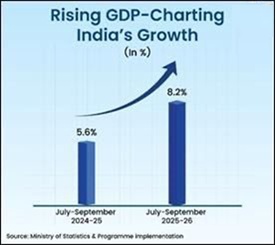

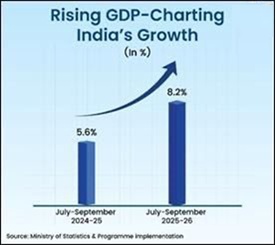

India recorded a strong 8.2% GDP growth, supported by robust manufacturing and services performance. However, the IMF graded India’s national income accounting system as ‘Grade C’, pointing to statistical limitations and structural data gaps.

Background & Context

- India is currently among the fastest-growing major economies, outpacing global growth expectations.

- The growth is taking place amid global economic uncertainties—weak global demand, geopolitical tensions, and tightening international financial conditions.

- The IMF’s assessment has reopened a key debate: Is strong economic growth sustainable without strengthening India’s statistical and institutional framework ?

Current Growth Performance

India’s GDP for the quarter rose to ₹48.63 lakh crore, surpassing last year’s output and showing sustained recovery beyond post-COVID normalisation.

Sector-wise Performance

- Manufacturing: ↑ 9.1% — improved industrial demand and rising capacity utilisation.

- Services: ↑ 9.2% — now 60% of GDP; financial services witnessed 10.2% growth.

- Agriculture: ↑ 3.5% — helped by better reservoir levels and horticulture output.

Additional Growth Indicators

- Real GVA: ₹82.88 lakh crore → ₹89.41 lakh crore — indicating genuine value addition.

- Nominal GDP: up 8.8%, reflecting subdued inflation.

- Private consumption: ↑ 7.9%, signalling strong household demand.

Macroeconomic Stability Indicators

India’s macroeconomic fundamentals remain stable:

- Inflation eased and remained close to the RBI’s target band.

- Bank credit grew steadily, supported by well-capitalised banks.

- Fiscal consolidation progressed: GST collections and direct tax revenues continued to perform strongly.

- Current account deficit remained modest—supported by strong services exports and stable forex reserves.

These indicators reinforce India’s economic resilience.

IMF’s Grade C Assessment: Implications

The IMF’s ‘Grade C’ rating reflects deficiencies in India’s statistical system, not its growth performance.

Key Concerns Highlighted by IMF

- Use of an outdated 2011–12 base year.

- Overreliance on WPI, absence of a comprehensive Producer Price Index (PPI).

- Single deflation method creating cyclical distortions.

- Mismatch between production and expenditure GDP estimates.

- Gaps in representing the informal sector.

- Absence of seasonally adjusted data.

- Lack of consolidated state and local government finances since 2019.

The IMF notes that India requires a stronger statistical backbone to match its economic scale.

Uneven Recovery Across Sectors

Growth is strong but not evenly distributed.

- Mining: barely grew (0.04%) — due to extended monsoon disruptions.

- Electricity, gas & utilities: ↑ 4.4%, limited by a milder winter reducing energy demand.

Sectoral Composition of GVA

- Primary sector: 14%

- Secondary sector: 26%

- Tertiary sector: 60%

Despite a high-services share, India’s workforce remains concentrated in low-productivity agriculture and informal services—reflecting a structural imbalance.

Structural Vulnerabilities

1. Weak Export Competitiveness

- Slow scaling of high-value manufacturing

- Global geopolitical uncertainties

- Frequent tariff changes impacting investor confidence

2. Low Labour Productivity

- Majority of labour still in low-productivity sectors

- Slow pace of formalisation despite rapid digital growth

3. Weak Institutional and Statistical Capacity

- Outdated base year

- Incomplete data representation

- Lack of uniform data from States and local bodies

4. Persistent External Pressures

- Rupee faces downward pressure due to a strong USD

- Volatile foreign capital flows

- Structural current account pressures

These vulnerabilities do not undermine India’s 8.2% growth but highlight the reforms needed to sustain long-term economic momentum.

FAQs

1. Does the IMF’s Grade C mean India’s GDP numbers are unreliable ?

No. It reflects weaknesses in data systems, not the GDP growth outcome. It calls for modernising India’s statistical framework.

2. Why is India’s GDP growth so strong despite global slowdown ?

Strong domestic demand, resilient manufacturing, expansion in services, and controlled inflation have supported growth.

3. Why is the base year 2011–12 considered outdated ?

It no longer captures current consumption patterns, production structures, digital activity, and post-pandemic economic shifts.

4. What sectors contributed most to the 8.2% growth ?

Manufacturing (9.1%) and services (9.2%), particularly financial services.

5. What does low mining and utilities growth indicate ?

It signals uneven recovery and weak performance in key input sectors that drive industrial activity.

|

Contact Us

Contact Us  New Batch : 9555124124/ 7428085757

New Batch : 9555124124/ 7428085757  Tech Support : 9555124124/ 7428085757

Tech Support : 9555124124/ 7428085757