Prelims: (Economy + CA)

Mains: (GS 2 – Governance; GS 3 – Economy) |

Why in the News ?

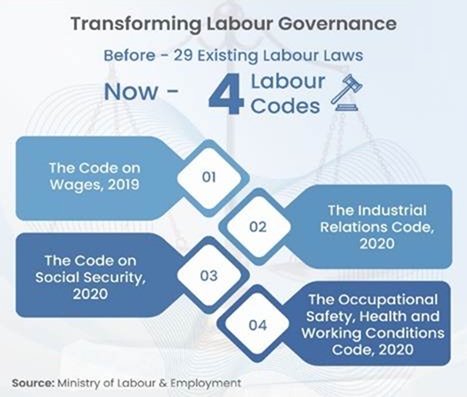

The Government of India has officially notified all Four Labour Codes, consolidating 29 labour laws into a unified, modern regulatory framework. This marks one of the most significant labour reforms since Independence, aimed at enhancing labour welfare, workplace safety, social security, and improving the ease of doing business.

Background

The Four Labour Codes

- Code on Wages, 2019

- Industrial Relations (IR) Code, 2020

- Code on Social Security, 2020

- Occupational Safety, Health and Working Conditions (OSHWC) Code, 2020

Why were they delayed ?

- Strong opposition from Central Trade Unions (CTUs).

- Concerns over worker protections, retrenchment, and right to strike.

- Despite the resistance, the Centre has now fully operationalised all four codes.

Systemic Reforms Introduced

- Gender-neutral work policies

- Uniform safety standards

- Streamlined contract labour regulation

- Nationwide ESIC & EPFO coverage

- National floor wage introduction

- Boost towards formalisation of the labour force

Key Features of the Four Labour Codes

1. Universal Social Security and Expanded Coverage

- Gig workers, platform workers, and aggregators brought under the statutory framework for the first time.

- ESIC coverage extended to every district, including hazardous industries.

- Universal Account Number (UAN): Aadhaar-linked, portable benefits for migrant workers.

- Accident compensation expanded to include commuting accidents.

- Aggregator contribution: 1–2% of annual turnover (capped at 5%) for gig worker social security funds.

2. Wages, Minimum Pay, and Timely Payment

- Introduction of a National Floor Wage.

- Mandatory timely payment of wages across all establishments.

- Wage definition revised — increases the basic wage proportion, enhancing PF & gratuity.

3. Women’s Rights and Workplace Safety

- Women allowed to work in:

- Night shifts

- Underground mines

- Hazardous machinery operations

—with consent and adequate safety measures.

- Equal pay for equal work mandated.

- Free annual health check-up for workers aged 40+.

4. Fixed Term Employment (FTE)

- Employers may hire for a fixed duration without reducing benefits.

- FTE workers receive:

- Same wages as permanent workers

- Medical, leave, and social security benefits

- Gratuity after 1 year (earlier 5 years)

5. Simplified Compliance & Ease of Doing Business

- Single registration, licence, and return system.

- Inspector-cum-facilitator for supportive compliance.

- Two-member Industrial Tribunals for quicker dispute resolution.

- National OSH Board to harmonize safety standards.

Stakeholder Responses

Government

- Calls it the most comprehensive labour reform since Independence.

- Claims it will formalise the labour market, provide global-standard protections, and support economic growth.

Industry (CII, FICCI)

- Welcomes codes as a historic milestone.

- Believes the framework increases predictability and ease of doing business.

Trade Unions (CTUs)

- Label the codes as:

- “Anti-worker, pro-employer”

- “Declaration of war on workers”

- Concerns over:

- FTE misuse

- Restrictions on the right to strike

- Retrenchment and closure norms

- Nationwide protests planned for 26 November.

Bharatiya Mazdoor Sangh (BMS)

- Partially supportive:

- Supports codes on Wages & Social Security

- Demands changes in OSHWC and IR Codes

Challenges and Concerns

- CTU Opposition: Fear of dilution of worker rights and strike restrictions.

- Implementation Capacity: Labour is a Concurrent Subject; State readiness varies.

- Risk of FTE Misuse: Employers may prefer short-term over permanent jobs.

- Gig worker social security: Scheme design and execution unclear.

- National Floor Wage: Requires State consensus and clear methodology.

- Digital Compliance: States need training, infrastructure, and workforce readiness.

Way Forward

- Strengthen consultation: Revive the Indian Labour Conference (ILC).

- Build State capacity: Provide financial & technical support for new compliance systems.

- Clear schemes for gig workers: Transparent contribution norms, seamless portability via UAN.

- Monitor FTE usage: Prevent replacement of permanent roles with FTE.

- Awareness campaigns: Informal workers must be made aware of new rights and protections.

|

FAQs

Q1: What is the major objective of implementing the Four Labour Codes?

Ans: To simplify India’s labour regulations by consolidating 29 laws, improving worker welfare, social security, and ease of doing business.

Q2: Which are the Four Labour Codes notified by the government?

Ans:

-

Code on Wages, 2019

-

Industrial Relations (IR) Code, 2020

-

Code on Social Security, 2020

-

Occupational Safety, Health and Working Conditions (OSHWC) Code, 2020

Q3: When were the Four Labour Codes fully implemented?

Ans: They were notified and operationalised by the Government of India recently, marking a major labour reform milestone.

Q4: Who benefits from the expanded social security coverage under the Codes?

Ans: Gig workers, platform workers, migrant workers, and workers in hazardous industries benefit from expanded ESIC and EPFO coverage.

Q5: What is Fixed Term Employment (FTE) as per the Codes?

Ans: A system allowing employers to hire workers for a specific duration with full benefits, including gratuity after 1 year.

|