(Mains GS 2 : Issues Relating to Development and Management of Social Sector/Services relating to Health, Education, Human Resources.)

Context:

- India is reported to have lost half a million of its people to the Covid-19 pandemic over the past two years which despite a high degree of societal attention remains a serious public health concern worldwide.

Silent killer:

- As estimated by scientific studies, tobacco emerged as a silent killer in our midst that kills an estimated 1.35 million Indians every year.

- It also comes at a heavy cost as its annual economic burden is of ₹1,77,340 crore to the country or more than 1% of India’s Gross Domestic Product (GDP).

- However, ever since the introduction of the Goods and Services Tax (GST) legislation in 2017, there has been no significant tax increase on any tobacco product barring a minor increase in the National Calamity Contingent Duty (NCCD) during the Union Budget 2020-2.

Overwhelming consensus:

- As per the World Health Organization, tobacco epidemic has some definitive solutions that can reduce the death toll.

- Research from many countries around the world including India shows that a price increase induces people to quit or reduce tobacco use as well as discourages non-users from getting into the habit of tobacco use.

- There is overwhelming consensus within the research community that taxation is one of the most cost-effective measures to reduce demand for tobacco products.

More affordable:

- There has been no significant tax increase on any tobacco product for four years in a row which is quite unlike the pre-GST years where the Union government and many State governments used to effect regular tax increases on tobacco products.

- As peer-reviewed studies show, the lack of tax increase over these years has made all tobacco products increasingly more affordable.

- The Union Budget 2022-23 was an excellent opportunity for the Government of India to buck this trend and significantly increase either excise duties or NCCDs on tobacco products.

Potential to reverse:

- The absence of a tax increase on tobacco has the potential to reverse the reduction in tobacco use prevalence that India saw during the last decade and now push more people into harm’s way.

- It is known that more affordable tobacco products could attract new users especially among the youth.

- It would also mean foregone tax revenues for the Government, especially at a time when the Government of India is looking forward to increasing the share of public spending on health.

Hope from the council:

- The Goods and Services Tax (GST) Council could well raise either the GST rate or the compensation cess levied on tobacco products especially when the Government is looking to rationalise GST rates and increase them for certain items.

- For example, there is absolutely no public health rationale why a very harmful product such as the bidi does not have a cess levied on it under the GST while all other tobacco products attract a cess.

- Similarly, there is no rationale why the specific cess applied on cigarettes has remained unchanged for four years in the face of increasing inflation.

- Since specific cess is applied as a fixed amount per stick of cigarettes, increasing inflation will decrease the significance of this particular tax component making cigarette prices more affordable and reducing its effective tax burden.

Conclusion:

- GST Council meetings must strive to keep public health ahead of the interests of the tobacco industry and significantly increase either the GST rates or the GST compensation cess rates applied on all tobacco products.

- The aim should be to arrest the increasing affordability of tobacco products in India and also rationalise tobacco taxation under the GST.

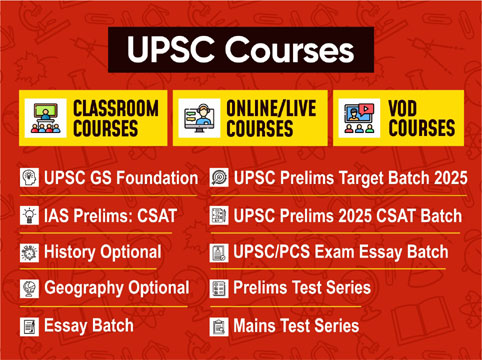

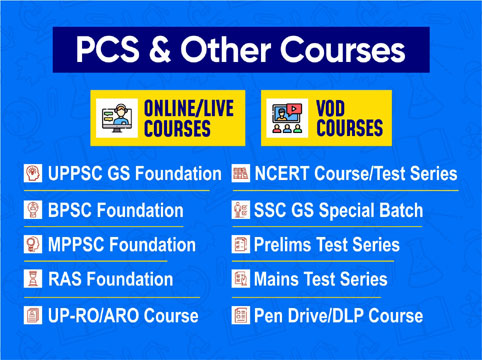

Contact Us

Contact Us  New Batch : 9555124124/ 7428085757

New Batch : 9555124124/ 7428085757  Tech Support : 9555124124/ 7428085757

Tech Support : 9555124124/ 7428085757