Prelims: (International Relations + CA)

Mains: (GS 2 – Separation of Powers, India–US Relations; GS 3 – External Sector, Global Trade Governance) |

Why in News?

The Supreme Court of the United States, in a 6–3 ruling, struck down President Donald Trump’s sweeping tariffs imposed under the International Emergency Economic Powers Act (IEEPA), 1977.

The judgment marks a critical intervention in the debate over executive overreach and separation of powers in trade policy. The ruling also has implications for global trade and countries like India that were directly impacted by US tariff actions.

Background and Context

Expansion of Executive Trade Powers

The US Constitution vests the power to levy taxes and tariffs in Congress. However, over decades, Congress delegated limited trade-related authority to the President through statutory frameworks.

IEEPA (1977), enacted under President Jimmy Carter, was designed to address national emergencies involving foreign threats—primarily through asset freezes and sanctions—not broad tariff imposition.

Trump became the first US President to invoke IEEPA for imposing sweeping tariffs without Congressional approval.

Constitutional Issue – Executive vs Legislative Authority

Core Principle

- Article I of the US Constitution grants Congress authority over taxation and tariffs.

- The President invoked IEEPA citing “national emergency” linked to trade deficits, fentanyl trafficking, and migration.

- The Court upheld lower federal rulings that such use exceeded statutory intent and constitutional limits.

Judicial Reasoning

- Emergency economic powers cannot substitute for legislative trade authority.

- Tariff imposition is fundamentally a taxation measure requiring Congressional mandate.

- Reaffirmation of judicial review and constitutional checks and balances.

Trump’s Tariff Strategy – Economic & Foreign Policy Instrument

Trade War and Strategic Leverage

Tariffs were used as:

- A revenue-generating mechanism (estimated $300 billion annually if retained).

- A diplomatic pressure tool against China, Canada, Mexico, India, and Brazil.

- A bargaining instrument to renegotiate trade agreements.

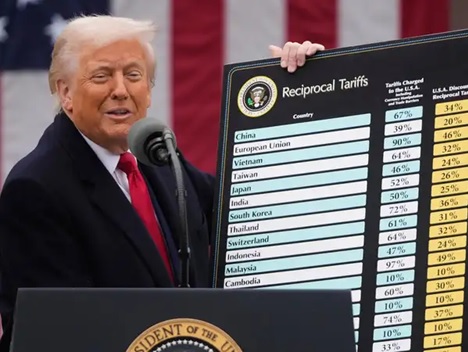

“Liberation Day” Tariffs (April 2, 2025)

- Announced reciprocal tariffs on most trading partners.

- Justified under a national emergency linked to trade deficits.

- Generated over $175 billion under IEEPA-based measures.

- FY 2025 customs duty receipts reached $195 billion (record high).

Following the ruling, refund liabilities may arise, adding fiscal uncertainty.

Legal Challenges and Federal Pushback

Three major lawsuits challenged the tariffs:

- Small importing businesses.

- Twelve US states (including Arizona, Colorado, New York).

- Federal courts ruled that emergency powers cannot override Congress’ taxation authority.

The Supreme Court decision reinforces limits on executive unilateralism in trade.

Alternative Tariff Mechanisms – Sections 122, 301, and 232

Following the ruling, alternative statutory routes were considered:

1. Section 122 – Trade Act, 1974

- Allows up to 15% tariffs for serious balance-of-payments deficits.

- Valid for 150 days unless extended by Congress.

- Never used previously.

- A 10% global tariff was reportedly considered under this route.

2. Section 301 – Trade Act, 1974

- Triggered after investigation by the US Trade Representative.

- Targets “unfair trade practices.”

- Previously invoked against India over Digital Services Tax (2020).

- Later resolved under the OECD global minimum tax arrangement.

3. Section 232 – Trade Expansion Act, 1962

- Allows tariffs on national security grounds.

- Sector-specific (steel, aluminium, automobiles, etc.).

- India currently faces Section 232 tariffs on steel, aluminium, automobiles, and copper derivatives.

- Some sectoral relief has emerged under recent US–India trade understandings.

Broader Implications

For the US Political System

- Reassertion of Congressional primacy in taxation.

- Curtailment of expansive executive interpretation of emergency powers.

- Strengthening of constitutional checks and balances.

For Global Trade

- Potential rollback or restructuring of tariff regimes.

- Short-term uncertainty due to refund liabilities and policy recalibration.

- Reinforcement of rules-based trade frameworks.

- Impact on WTO dynamics and global governance debates.

For India

- Possible relief in select sectors (aircraft parts, auto components).

- Continued exposure to Section 232 tariffs.

- Increased importance of trade diplomacy and diversification of exports.

- Strategic positioning amid US–China trade rivalry.

Challenges and Way Forward

Institutional Tensions

- Ongoing friction between executive flexibility and legislative oversight in trade policy.

- Need for clearer statutory boundaries.

Risk of Renewed Protectionism

- Alternative provisions (122, 301, 232) may still enable targeted protectionism.

- National security justification remains broad and flexible.

Global Supply Chain Stability

- Policy unpredictability affects investment and trade flows.

- Greater adherence to WTO-consistent, transparent measures required.

For India

- Strengthen bilateral trade negotiations.

- Diversify export markets.

- Leverage ongoing strategic partnership with the US while hedging risks.

FAQs

1. Why did the Supreme Court strike down the tariffs?

Because IEEPA does not explicitly authorize tariff imposition, and taxation authority lies with Congress.

2. What is IEEPA meant for?

It is designed to address national emergencies through sanctions, asset freezes, and financial restrictions—not broad-based tariffs.

3. Can the President still impose tariffs?

Yes, but through statutory mechanisms like Sections 122, 301, or 232, subject to procedural limits.

4. How does this affect India?

India may gain relief in certain sectors but remains exposed to sector-specific tariffs under Section 232.

5. What is the larger global significance?

The ruling reinforces constitutional limits while highlighting how trade policy increasingly functions as a geopolitical tool.

|